Renters Insurance in and around Miami

Your renters insurance search is over, Miami

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

No matter what you're considering as you rent a home - furnishings, number of bathrooms, utilities, house or townhome - getting the right insurance can be necessary in the event of the unexpected.

Your renters insurance search is over, Miami

Your belongings say p-lease and thank you to renters insurance

Why Renters In Miami Choose State Farm

The unpredictable happens. Unfortunately, the personal belongings in your rented property, such as a tool set, a stereo and a couch, aren't immune to theft or accident. Your good neighbor, agent Martina Turner, has the knowledge needed to help you examine your needs and find the right insurance options to protect your personal posessions.

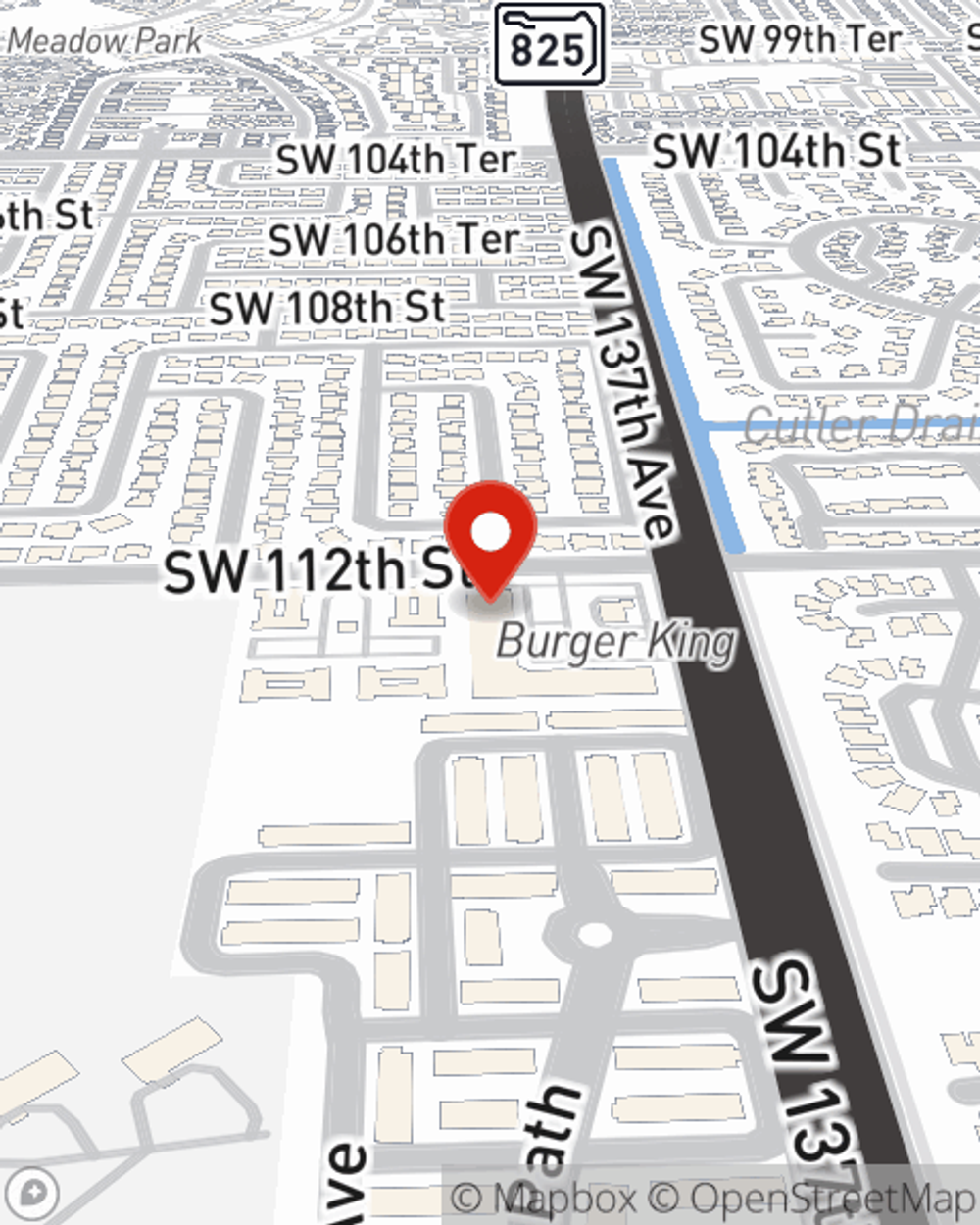

It's always a good idea to make sure you're prepared. Visit State Farm agent Martina Turner for help understanding options for your policy for your rented unit.

Have More Questions About Renters Insurance?

Call Martina at (305) 388-0000 or visit our FAQ page.

Simple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

Martina Turner

State Farm® Insurance AgentSimple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.