Life Insurance in and around Miami

Protection for those you care about

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

State Farm Offers Life Insurance Options, Too

No one likes to fixate on death. But taking the time now to secure a life insurance policy with State Farm is a way to show care to your family if you pass.

Protection for those you care about

Now is the right time to think about life insurance

Love Well With Life Insurance

Death may be part of life but that doesn’t make it easy. With life insurance from State Farm, loss can be a bit less overwhelming. Life insurance provides financial support when it’s needed most. Coverage from State Farm allows time to grieve without worrying about expenses like medical expenses, ongoing expenses or childcare costs. You can work with State Farm Agent Martina Turner to demonstrate love for the ones you hold dear with a policy that meets your specific situation and needs. With life insurance from State Farm, you and your loved ones will be cared for every step of the way.

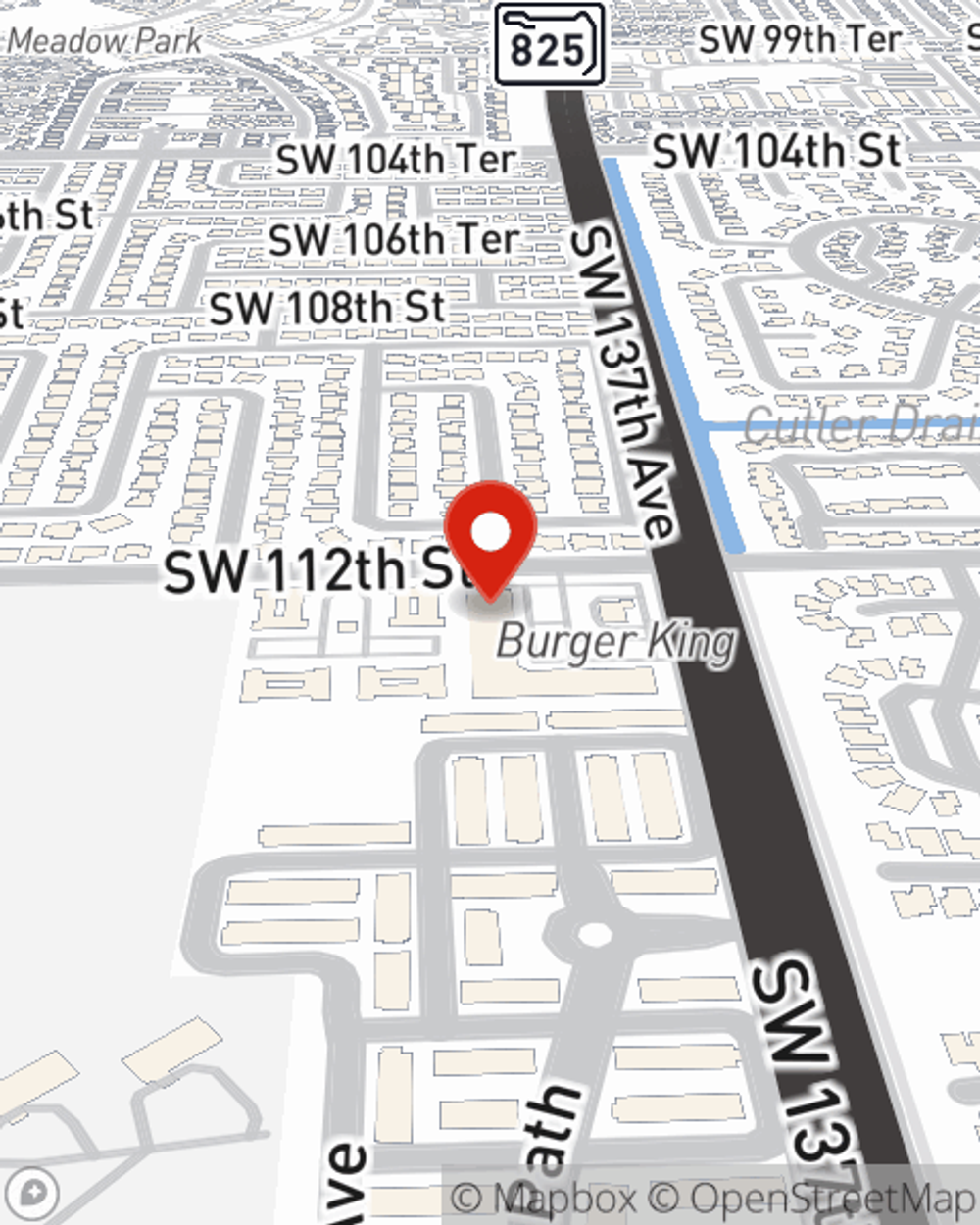

If you're looking for reliable protection and caring service, you're in the right place. Contact State Farm agent Martina Turner now to see which Life insurance options are right for you and your loved ones.

Have More Questions About Life Insurance?

Call Martina at (305) 388-0000 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Martina Turner

State Farm® Insurance AgentSimple Insights®

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.